티스토리 뷰

금융 정보통/ETF, 펀드, 채권

Kodex TSE일본리츠(H) 기본정보 수익률 종목구성 분배금 월배당 과세 개인연금ETF 일본리츠ETF 투자방법

나누리_00 2024. 1. 9. 10:41반응형

Kodex TSE일본리츠(H) 알아보기

Tokyo Stock Exchange REIT지수를 기초지수로 하여 1 좌당 순자산가치의 변동률을 기초지수의 변동률과 유사하도록 투자신탁재산을 운 용하여 투자대상 자산의 가치상승에 따른 수익을 추구합니다.

목차

4. Kodex TSE일본리츠(H) ETF 분배금 지급 현황

6. Kodex TSE일본리츠(H) ETF 기준가격(최근 3개월)

1. Kodex TSE일본리츠(H) ETF 기본정보

도쿄거래소에 상장된 모든 리츠(REITs)와 부동산개발,관리,보유,중개 등 부동산 관련 기업에 투자합니다.

직접투자와 달리 세금이나 보험료 없이 임대료 수취가 가능하고, 거래소에 상장되어 있어 거래 편리성이 높습니다.

주식이나 채권과의 상관관계가 낮은 대체투자로서, 포트폴리오 분산에 용이합니다.

Kodex TSE일본리츠(H)ETF는 환헤지(H)가 적용된 상품으로 엔/원 환율의 등폭락에 영향받지 않도록 설계된 상품입니다.

1)상품정보

| ETF명 | Kodex TSE일본리츠(H) |

| 상장일 | 2020.05.13 |

| 기초지수 | Tokyo Stock Exchange REIT Index |

| ETF 순자산총액 | 151.51억원 |

| 1주당순자산(NAV) | 11,654.34원 |

| 총보수율(TER) | 연 0.3% (지정판매 0.01%, 집합투자 0.25%, 신탁 0.02%, 일반사무 0.02%) |

| 분배금기준일 | 매월 지급 |

| 집합투자업자(운용) | 삼성자산운용 |

| 사무수탁회사 | 신한펀드파트너스 |

| 수탁은행 | 하나은행 |

| 환매방법 | 유가증권 시장을 통한 매도, 지정참가회사를 통한 해지에 의한 환매 |

2)기초지수정보

Tokyo Stock Exchange REIT Index

동경거래소에 상장된 모든 REIT로 구성된 지수입니다.

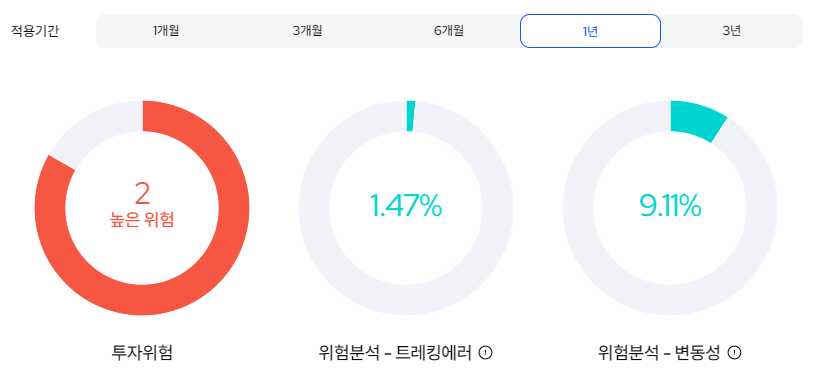

3)위험수준

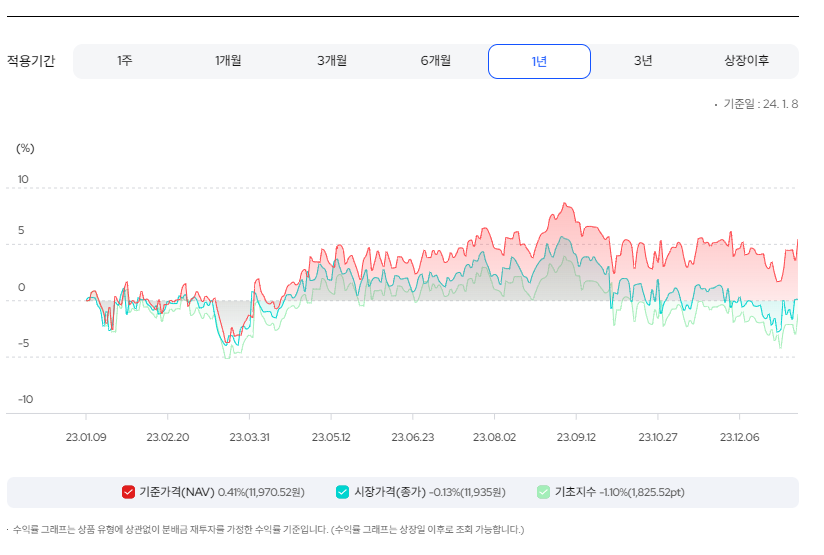

2. Kodex TSE일본리츠(H) ETF 수익률

1)기간별 수익률

2)수익률 그래프

3. Kodex TSE일본리츠(H) ETF 구성종목

2024. 1. 9

| 번호 | 종목명 | ISIN | 종목코드 | 수량 | 비중(%) | 평가금액(원) |

| 1 | 설정현금액 | CASH00000001 | CASH00000001 | 1,196,941,260 | 0.00% | 1,196,941,260 |

| 2 | 외국환포워드JPY | FXFWD0000JPY | FXFWD0000JPY | -1,165,496,498 | 0.00% | -1,165,496,498 |

| 3 | 원화현금 | KRD010010001 | KRD010010001 | 17,302,417 | 0.00% | 17,302,417 |

| 4 | NIPPON BUILDING FUND INC | JP3027670003 | 8951 JP Equity | 15 | 6.80% | 82,152,573 |

| 5 | JAPAN REAL ESTATE INVESTMENT | JP3027680002 | 8952 JP Equity | 13 | 5.64% | 68,188,773 |

| 6 | NOMURA REAL ESTATE MASTER FU | JP3048110005 | 3462 JP Equity | 40 | 5.03% | 60,846,927 |

| 7 | JAPAN RETAIL FUND INVESTMENT | JP3039710003 | 8953 JP Equity | 60 | 4.62% | 55,791,450 |

| 8 | NIPPON PROLOGIS REIT INC | JP3047550003 | 3283 JP Equity | 22 | 4.49% | 54,227,264 |

| 9 | GLP J-REIT | JP3047510007 | 3281 JP Equity | 42 | 4.48% | 54,157,793 |

| 10 | Kenedix Office Investment Corp | JP3046270009 | 8972 JP Equity | 36 | 4.45% | 53,764,156 |

| 11 | DAIWA HOUSE REIT | JP3046390005 | 8984 JP Equity | 19 | 3.61% | 43,620,314 |

| 12 | ORIX JREIT INC | JP3040880001 | 8954 JP Equity | 25 | 3.16% | 38,142,328 |

| 13 | UNITED URBAN INVESTMENT CORP | JP3045540006 | 8960 JP Equity | 28 | 3.06% | 37,038,284 |

| 14 | ADVANCE RESIDENCE INVESTMENT | JP3047160001 | 3269 JP Equity | 12 | 2.98% | 36,001,640 |

| 15 | INVINCIBLE INVESTMENT CORP | JP3046190009 | 8963 JP Equity | 60 | 2.80% | 33,810,694 |

| 16 | Tokyo REIT 2024 03 | TREH4INDEX00 | TREH4 Equity | 2 | 2.41% | 29,145,795 |

| 17 | JAPAN PRIME REALTY INVESTMEN | JP3040890000 | 8955 JP Equity | 9 | 2.30% | 27,789,678 |

| 18 | SEKISUI HOUSE REIT INC | JP3047820000 | 3309 JP Equity | 37 | 2.21% | 26,681,618 |

| 19 | JAPAN HOTEL REIT INVESTMENT | JP3046400002 | 8985 JP Equity | 42 | 2.19% | 26,523,497 |

| 20 | INDUSTRIAL & INFRASTRUCTURE | JP3046500009 | 3249 JP Equity | 19 | 2.04% | 24,609,461 |

| 21 | NIPPON ACCOMMODATIONS FUND | JP3046440008 | 3226 JP Equity | 4 | 1.98% | 23,919,217 |

| 22 | ACTIVIA PROPERTIES INC | JP3047490002 | 3279 JP Equity | 7 | 1.94% | 23,460,454 |

| 23 | LASALLE LOGIPORT REIT | JP3048180008 | 3466 JP Equity | 16 | 1.84% | 22,189,535 |

| 24 | MITSUI FUDOSAN LOGISTICS PAR | JP3048300002 | 3471 JP Equity | 5 | 1.79% | 21,694,270 |

| 25 | JAPAN LOGISTICS FUND INC | JP3046230003 | 8967 JP Equity | 8 | 1.72% | 20,840,592 |

| 26 | AEON REIT INVESTMENT | JP3047650001 | 3292 JP Equity | 15 | 1.63% | 19,726,426 |

| 27 | MORI HILLS REIT INVESTMENT C | JP3046470005 | 3234 JP Equity | 15 | 1.56% | 18,909,643 |

| 28 | FRONTIER REAL ESTATE INVEST | JP3046200006 | 8964 JP Equity | 5 | 1.52% | 18,323,054 |

| 29 | COMFORIA RESIDENTIAL REIT IN | JP3047540004 | 3282 JP Equity | 6 | 1.46% | 17,682,830 |

| 30 | JAPAN RENTAL HOUSING INVESTM | JP3046410001 | 8986 JP Equity | 18 | 1.44% | 17,465,086 |

| 31 | MORI TRUST REIT INC | JP3046170001 | 8961 JP Equity | 24 | 1.34% | 16,254,786 |

| 32 | Daiwa Office Investment Corp | JP3046310003 | 8976 JP Equity | 3 | 1.34% | 16,214,258 |

| 33 | HULIC REIT INC | JP3047660000 | 3295 JP Equity | 12 | 1.32% | 15,941,574 |

| 34 | MITSUBISHI ESTATE LOGISTICS | JP3048480002 | 3481 JP Equity | 4 | 1.22% | 14,752,806 |

| 35 | PREMIER INVESTMENT CO | JP3041770003 | 8956 JP Equity | 12 | 1.14% | 13,768,373 |

| 36 | TOKYU REIT INC | JP3044510000 | 8957 JP Equity | 8 | 1.08% | 13,084,473 |

| 37 | NIPPON REIT INVESTMENT CORP | JP3047750009 | 3296 JP Equity | 4 | 1.06% | 12,773,808 |

| 38 | JAPAN EXCELLENT INC | JP3046420000 | 8987 JP Equity | 11 | 1.02% | 12,379,578 |

| 39 | HOSHINO RESORTS REIT INC | JP3047610005 | 3287 JP Equity | 2 | 1.00% | 12,124,000 |

| 40 | HEIWA REAL ESTATE REIT Inc | JP3046220004 | 8966 JP Equity | 9 | 0.95% | 11,523,263 |

| 41 | STAR ASIA INVESTMENT CORPORA | JP3048200004 | 3468 JP Equity | 19 | 0.85% | 10,243,125 |

| 42 | FUKUOKA REIT CORP | JP3046240002 | 8968 JP Equity | 6 | 0.83% | 10,006,460 |

| 43 | GLOBAL ONE REIT | JP3044520009 | 8958 JP Equity | 9 | 0.76% | 9,228,890 |

| 44 | ICHIGO OFFICE REIT INVESTMEN | JP3046300004 | 8975 JP Equity | 10 | 0.64% | 7,750,323 |

| 45 | CRE LOGISTICS REIT INC | JP3048680007 | 3487 JP Equity | 5 | 0.63% | 7,587,118 |

| 46 | Hankyu Hanshin REIT Inc | JP3046320002 | 8977 JP Equity | 6 | 0.62% | 7,527,295 |

| 47 | SOSILA LOGISTICS REIT INC | JP3048960003 | 2979 JP Equity | 6 | 0.56% | 6,818,256 |

| 48 | MIRAI CORP | JP3048370005 | 3476 JP Equity | 16 | 0.53% | 6,415,638 |

| 49 | ITOCHU ADVANCE LOGISTICS INV | JP3048770006 | 3493 JP Equity | 5 | 0.52% | 6,324,415 |

| 50 | TAKARA LEBEN REAL ESTATE INV | JP3048750008 | 3492 JP Equity | 6 | 0.46% | 5,500,923 |

| 51 | ONE REIT INC | JP3047640002 | 3290 JP Equity | 2 | 0.44% | 5,288,875 |

| 52 | HEALTHCARE & MEDICAL INVESTM | JP3047910009 | 3455 JP Equity | 3 | 0.33% | 3,969,643 |

| 53 | STARTS PROCEED INVESTMENT CO | JP3046340000 | 8979 JP Equity | 2 | 0.33% | 3,952,428 |

| 54 | SAMTY RESIDENTIAL INVESTMENT | JP3047960004 | 3459 JP Equity | 3 | 0.28% | 3,396,801 |

| 55 | SANKEI REAL ESTATE INC | JP3048880003 | 2972 JP Equity | 4 | 0.28% | 3,344,425 |

| 56 | TOSEI REIT INVESTMENT CORP | JP3047830009 | 3451 JP Equity | 3 | 0.27% | 3,281,115 |

| 57 | ESCON JAPAN REIT INVESTMENT | JP3048810000 | 2971 JP Equity | 3 | 0.23% | 2,745,058 |

| 58 | XYMAX REIT INVESTMENT CORP | JP3048690006 | 3488 JP Equity | 2 | 0.18% | 2,185,195 |

| 59 | MARIMO REGIONAL REVITALIZATI | JP3048290005 | 3470 JP Equity | 2 | 0.18% | 2,153,868 |

| 60 | Tokaido REIT Inc | JP3049110004 | 2989 JP Equity | 2 | 0.18% | 2,147,953 |

| 61 | ICHIGO HOTEL REIT INVESTMENT | JP3048160000 | 3463 JP Equity | 2 | 0.18% | 2,143,499 |

| 62 | OOEDO ONSEN REIT INVESTMENT | JP3048310001 | 3472 JP Equity | 2 | 0.10% | 1,253,064 |

4. Kodex TSE일본리츠(H) ETF 분배금 지급 현황

| 지급기준일 | 실지급일 | 분배금액(원) | 주당 과세 표준액(원) |

| 2023. 12. 28 | 2024. 01. 03 | 80 | 80 |

| 2023. 11. 30 | 2023. 12. 04 | 80 | 80 |

| 2023. 10. 31 | 2323. 11. 02 | 80 | 80 |

| 2023. 09. 27 | 2023. 10. 05 | 75 | 75 |

| 2023. 08. 31 | 2023. 09. 04 | 40 | 40 |

| 2023. 07. 31 | 2023. 08. 02 | 43 | 43 |

| 2023. 06 .30 | 2023. 07. 04 | 43 | 43 |

| 2023. 05. 31 | 2023. 06. 02 | 50 | 50 |

| 2023. 04. 28 | 2023. 05. 03 | 50 | 50 |

| 2023. 03. 31 | 2023. 04. 04 | 50 | 50 |

| 2023. 02. 28 | 2023. 03. 03 | 30 | 30 |

5. Kodex TSE일본리츠(H) ETF 과세

- 매매차익은 배당소득세 과세(보유기간 과세) : Min(매매차익, 과표 증분) X 15.4%

- 분배금은 배당소득세 과세 : Min(현금분배금, 과표증분) X 15.4%

6. Kodex TSE일본리츠(H) ETF 기준가격

2024. 1. 8

| 일자 | 거래가격(원) | 펀드기준가격(원) | 과표기준가(원) | |||||

| 종가 | 증감 | 증감율 | 거래량 | 기준가격 | 증감 | 증감율 | ||

| 20240108 | 11,965 | 5 | 0.04% | 3,522 | 11,969.41 | 205.66 | 1.75% | 11,969.41 |

| 20240105 | 11,960 | 200 | 1.70% | 40,746 | 11,763.75 | -98.21 | -0.83% | 11,763.75 |

| 20240104 | 11,760 | -95 | -0.80% | 18,026 | 11,861.96 | 4.45 | 0.04% | 11,861.96 |

| 20240103 | 11,855 | 50 | 0.42% | 12,538 | 11,857.51 | -0.91 | -0.01% | 11,857.51 |

| 20240102 | 11,805 | 80 | 0.68% | 12,051 | 11,858.42 | 204.08 | 1.75% | 11,858.42 |

| 20231228 | 0 | 0 | 0.00% | 0 | 11,654.34 | -0.39 | 0.00% | 11,654.34 |

| 20231227 | 11,640 | 100 | 0.87% | 9,416 | 11,551.22 | 7.76 | 0.07% | 11,551.22 |

| 20231226 | 11,620 | -140 | -1.19% | 44,992 | 11,543.46 | -157.63 | -1.35% | 11,543.46 |

| 20231222 | 11,760 | 65 | 0.56% | 14,807 | 11,701.09 | -117.60 | -1.00% | 11,701.09 |

| 20231221 | 11,695 | -110 | -0.93% | 11,148 | 11,818.69 | 63.40 | 0.54% | 11,818.69 |

| 20231220 | 11,805 | 45 | 0.38% | 15,889 | 11,755.29 | -35.61 | -0.30% | 11,755.29 |

| 20231219 | 11,760 | -30 | -0.25% | 23,373 | 11,790.90 | -114.25 | -0.96% | 11,790.90 |

| 20231218 | 11,790 | -110 | -0.92% | 25,132 | 11,905.15 | 7.05 | 0.06% | 11,905.15 |

| 20231215 | 11,900 | 10 | 0.08% | 25,612 | 11,898.10 | -2.84 | -0.02% | 11,898.10 |

| 20231214 | 11,890 | -5 | -0.04% | 31,679 | 11,900.94 | -48.67 | -0.41% | 11,900.94 |

| 20231213 | 11,895 | -45 | -0.38% | 18,081 | 11,949.61 | -14.17 | -0.12% | 11,949.61 |

| 20231212 | 11,940 | -10 | -0.08% | 16,478 | 11,963.78 | 57.92 | 0.49% | 11,963.78 |

| 20231211 | 11,950 | 40 | 0.34% | 13,106 | 11,905.86 | 8.35 | 0.07% | 11,905.86 |

| 20231208 | 11,910 | 25 | 0.21% | 30,726 | 11,897.51 | -122.73 | -1.02% | 11,897.51 |

| 20231207 | 11,885 | -105 | -0.88% | 25,953 | 12,020.24 | 58.82 | 0.49% | 12,020.24 |

| 20231206 | 11,990 | 60 | 0.50% | 18,450 | 11,961.42 | 11.03 | 0.09% | 11,961.42 |

| 20231205 | 11,930 | -15 | -0.13% | 15,633 | 11,950.39 | 65.64 | 0.55% | 11,950.39 |

| 20231204 | 11,945 | 65 | 0.55% | 7,168 | 11,884.75 | -242.77 | -2.00% | 11,884.75 |

| 20231201 | 11,880 | -190 | -1.57% | 23,832 | 12,127.52 | 140.46 | 1.17% | 12,127.52 |

| 20231130 | 12,070 | 130 | 1.09% | 27,225 | 11,987.06 | -35.93 | -0.30% | 11,987.06 |

| 20231129 | 11,940 | -70 | -0.58% | 84,998 | 12,022.99 | -26.60 | -0.22% | 12,022.99 |

| 20231128 | 12,090 | -25 | -0.21% | 56,930 | 12,049.59 | -67.21 | -0.55% | 12,049.59 |

| 20231127 | 12,115 | 15 | 0.12% | 27,936 | 12,116.80 | 16.12 | 0.13% | 12,116.80 |

| 20231124 | 12,100 | 15 | 0.12% | 27,204 | 12,100.68 | 2.87 | 0.02% | 12,100.68 |

| 20231123 | 12,085 | 5 | 0.04% | 9,273 | 12,097.81 | 35.89 | 0.30% | 12,097.81 |

| 20231122 | 12,080 | 35 | 0.29% | 46,824 | 12,061.92 | -39.56 | -0.33% | 12,061.92 |

| 20231121 | 12,045 | -35 | -0.29% | 123,642 | 12,101.48 | 6.90 | 0.06% | 12,101.48 |

| 20231120 | 12,080 | 5 | 0.04% | 85,932 | 12,094.58 | -52.66 | -0.43% | 12,094.58 |

| 20231117 | 12,075 | -45 | -0.37% | 88,902 | 12,147.24 | 6.35 | 0.05% | 12,147.24 |

| 20231116 | 12,120 | 15 | 0.12% | 25,865 | 12,140.89 | 138.30 | 1.15% | 12,140.89 |

| 20231115 | 12,105 | 130 | 1.09% | 36,473 | 12,002.59 | 123.35 | 1.04% | 12,002.59 |

| 20231114 | 11,975 | 110 | 0.93% | 19,093 | 11,879.24 | -35.60 | -0.30% | 11,879.24 |

| 20231113 | 11,865 | -40 | -0.34% | 75,294 | 11,914.84 | 67.21 | 0.57% | 11,914.84 |

| 20231110 | 11,905 | 55 | 0.46% | 41,603 | 11,847.63 | -84.19 | -0.71% | 11,847.63 |

| 20231109 | 11,850 | -85 | -0.71% | 38,693 | 11,931.82 | -133.60 | -1.11% | 11,931.82 |

| 20231108 | 11,935 | -110 | -0.91% | 3,711 | 12,065.42 | -36.54 | -0.30% | 12,065.42 |

| 20231107 | 12,045 | -40 | -0.33% | 38,726 | 12,101.96 | 53.85 | 0.45% | 12,101.96 |

| 20231106 | 12,085 | 45 | 0.37% | 41,227 | 12,048.11 | -3.08 | -0.03% | 12,048.11 |

| 20231103 | 12,040 | 10 | 0.08% | 3,768 | 12,051.19 | 53.18 | 0.44% | 12,051.19 |

| 20231102 | 12,030 | 60 | 0.50% | 95,562 | 11,998.01 | 58.68 | 0.49% | 11,998.01 |

| 20231101 | 11,970 | 55 | 0.46% | 56,308 | 11,939.33 | 81.60 | 0.69% | 11,939.33 |

| 20231031 | 11,915 | 100 | 0.85% | 694 | 11,857.73 | -252.63 | -2.09% | 11,857.73 |

| 20231030 | 11,815 | -275 | -2.27% | 2,188 | 12,110.36 | 204.68 | 1.72% | 12,110.36 |

| 20231027 | 12,170 | 220 | 1.84% | 3,737 | 11,905.68 | -175.93 | -1.46% | 11,905.68 |

| 20231026 | 11,950 | -110 | -0.91% | 746 | 12,081.61 | 168.33 | 1.41% | 12,081.61 |

| 20231025 | 12,060 | 155 | 1.30% | 2,651 | 11,913.28 | -10.61 | -0.09% | 11,913.28 |

| 20231024 | 11,905 | -35 | -0.29% | 3,290 | 11,923.89 | -90.80 | -0.76% | 11,923.89 |

| 20231023 | 11,940 | -95 | -0.79% | 111,167 | 12,014.69 | -151.27 | -1.24% | 12,014.69 |

| 20231020 | 12,035 | -95 | -0.78% | 1,963 | 12,165.96 | -11.77 | -0.10% | 12,165.96 |

| 20231019 | 12,130 | 5 | 0.04% | 808 | 12,177.73 | 65.58 | 0.54% | 12,177.73 |

| 20231018 | 12,125 | 10 | 0.08% | 1,527 | 12,112.15 | 192.22 | 1.61% | 12,112.15 |

| 20231017 | 12,115 | 170 | 1.42% | 872 | 11,919.93 | -222.80 | -1.83% | 11,919.93 |

| 20231016 | 11,945 | -200 | -1.65% | 1,548 | 12,142.73 | -56.78 | -0.47% | 12,142.73 |

| 20231013 | 12,145 | -40 | -0.33% | 506 | 12,199.51 | -9.92 | -0.08% | 12,199.51 |

| 20231012 | 12,185 | 0 | 0.00% | 889 | 12,209.43 | 32.16 | 0.26% | 12,209.43 |

| 20231011 | 12,185 | 25 | 0.21% | 1,933 | 12,177.27 | 129.02 | 1.07% | 12,177.27 |

| 20231010 | 12,160 | 135 | 1.12% | 2,012 | 12,048.25 | 5.61 | 0.05% | 12,048.25 |

728x90

'금융 정보통 > ETF, 펀드, 채권' 카테고리의 다른 글

| Kodex 미국배당프리미엄액티브 기본정보 수익률 과세 월배당ETF 분배금 기간수익률 구성 종목 (0) | 2024.02.23 |

|---|---|

| ETF 연금투자 연금저축 연금저축해외ETF 수수료 투자 세금 투자가능종목 연금투자의장점 (0) | 2024.01.09 |

| Kodex 미국S&P500헬스케어 ETF 기본정보 거래정보 수익률 종목구성 과세 개인연금 해외주식 퇴직연금 기준가격 (0) | 2024.01.05 |

| Kodex 골드선물(H) ETF 기본정보 거래정보 수익률 종목구성 과세 개인연금 금ETF (0) | 2024.01.04 |

| Kodex K-로봇액티브 ETF 기본정보 거래정보 수익률 종목구성 과세 분배금 개인연금 퇴직연금 iselectK-로봇지수 (0) | 2024.01.03 |

반응형

공지사항

최근에 올라온 글

최근에 달린 댓글

- Total

- Today

- Yesterday

링크

TAG

- 기후동행

- 건국대논술전형경쟁률

- 수능성적표배부

- Kodex인도Nifty50ETF

- 건국대학교수시논술전형

- 정시전형일정

- 논술대비이슈와시사

- 설맞이할인

- 수시논술전형특징

- 2023대학수학능력시험

- 건국대논술전형입시결과

- 학생부교과전형대학세특

- 국가장학금학정

- 수능성적표온라인조회

- 한국외대수시논술

- 정시전형등급

- 수능최저학력기준없는논술고사전형

- 학생부종합전형특징

- 한국외대논술전형

- 무제한대중교통

- 학생부종합전형평가요소

- 깜박이는버튼

- 저소득아동지원

- 불리한내신으로

- 반영과목

- 논술고사일정

- 건국대논술전형

- 기후동행카드

- 한국외대논술수능최저

- 기후동행카드요금제

| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

글 보관함